6 Fastest Ways to Look Up Personal Tax Codes in 2024

In modern life, personal tax codes have become an indispensable part of tax management for each citizen. Looking up your tax code not only helps you understand your tax information but is also a condition for carrying out legal financial transactions. This article will guide you through 6 ways to look up your personal tax code fastest in 2024.

What is a personal tax code?

A personal tax code is a series of numbers issued by the tax authority to manage each individual's personal income tax. For each individual, this tax code is unique, like a "key" that connects you and the tax authority. The tax code helps the management agency easily monitor and control each individual's tax obligations, thereby ensuring transparency and fairness in the tax system.

Each individual needs a tax identification number to:

- Pay personal income tax.

- Enjoy tax exemptions.

- Avoid penalties for tax-related errors or violations.

Metaphorically, the personal tax identification number is like a financial identification card, every time you earn income, this card records and ensures that you fully fulfill your civic responsibility regarding taxes.

How to look up personal tax code at Electronic Tax

Looking up your personal tax code through the Electronic Tax Portal is a simple and safe way. Here are the steps you need to take:

- Step 1 : Access the Electronic Tax page at https://thuedientu.gdt.gov.vn . In the right corner of the homepage, select " Individual " to log in.

- Step 2 : Select “ Taxpayer Information Lookup ”. Then, fill in all the information: document type (CCCD/ID card), document number, and verification code.

- Step 3 : Click “ Search ”. The results will include tax code information, taxpayer name, tax authority, CCCD or ID number, and your tax code usage status.

How to look up personal tax code at General Department of Taxation

The General Department of Taxation website is one of the most reputable places to look up personal tax codes .

- Step 1 : Access the address http://tracuunnt.gdt.gov.vn .

- Step 2 : Enter your ID card number and the provided confirmation code.

- Step 3 : Click “ Search ” to get results, including tax code, tax authority, and other related information.

How to look up personal tax code on eTax Mobile application

eTax Mobile is the official mobile application of the General Department of Taxation, helping users easily look up and manage tax information anytime, anywhere.

- Step 1 : Download the eTax Mobile app from the app store (Android or iOS).

- Step 2 : Log in and select " Look up NNT information ".

- Step 3 : Enter your CCCD or ID number, then click “ Search ”. The results include the tax code, taxpayer name, and related information.

How to look up personal tax code on TracuuMST

The TracuuMST website is a free and easy-to-use personal tax code lookup tool.

- Step 1 : Access the page https://tracuumst.com .

- Step 2 : Enter CCCD or ID card number.

- Step 3 : Click " Search " to receive personal tax code search results.

How to look up personal tax code via Tax Code

Masothue.com is another online tool that helps you look up your personal tax code using your CCCD or ID number.

- Step 1 : Access the Tax Code website .

- Step 2 : Enter your CCCD or ID card number in the search box.

- Step 3 : Click “ Search ” and wait for the results to display.

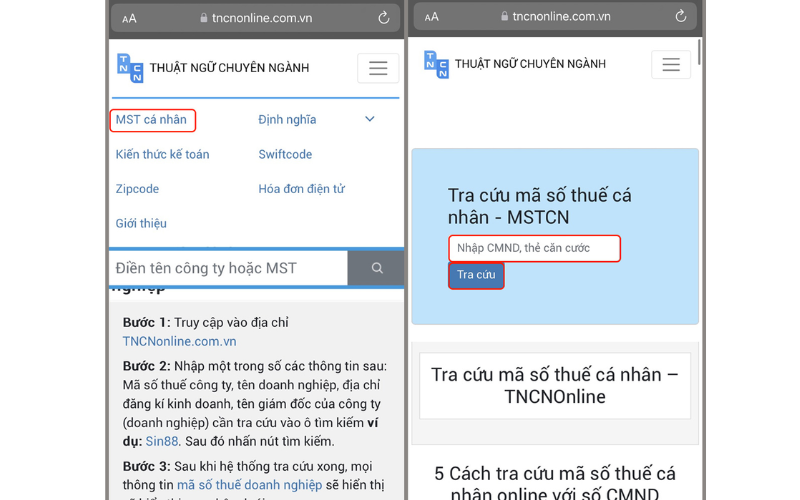

How to look up personal tax code online

TNCN Online is another website that helps users look up personal tax codes quickly.

- Step 1 : Access https://tncnonline.com.vn .

- Step 2 : Enter your CCCD or ID card number in the search box.

- Step 3 : Click “ Search ” to view information about your tax code.

- Step 4: Get results.

Some frequently asked questions about Personal Tax Code

1. Why do 2 personal tax codes appear when looking up?

When looking up your tax code, there are cases where you will see two different tax codes. The common reasons are:

- Using different types of documents: If you previously registered for tax with your National Identity Card (ID) and then changed to a Citizen Identification Card (CCCD) without updating your information with the tax authorities, you may be issued a new tax code .

- Registering with multiple tax authorities: When registering for tax in multiple places, especially when there are multiple sources of income from different authorities, having two tax codes can also happen.

How to handle: To solve this problem, you should contact the tax authority to request a tax code merger , making sure to use only one code.

2. Do non-employee people have a personal tax code?

Yes. Even if you are not officially employed, you can still have a personal tax code if you have taxable income sources, such as:

- Income from sale or rental of real estate

- Dividend income

- Lottery winnings

- Franchise or investment income

No. Personal tax code is fixed and is issued only to each individual. When you change from ID card to CCCD, your tax code will not change. However, you need to update your personal information with the tax authority to synchronize the data.

4. Is it okay if I don't have a tax code?

Yes. If you do not register for a personal tax code , you may encounter the following difficulties:

- Unable to legally pay taxes or declare income

- Not entitled to tax incentives, such as family deductions

- Having problems when making transactions related to finance and business

According to Vietnamese law, each individual is only given a single personal tax code . This helps tax authorities manage more effectively and avoid tax evasion or inaccurate income declaration.

What role does a personal tax number play in online marketing?

Personal Tax Identification Number (PTI) is a series of numbers used to identify individual taxpayers, issued by the tax authority to manage each individual's tax obligations. With the trend of digitalization in business and marketing, personal tax identification numbers have become an indispensable part for those working in the field of online marketing, especially when working with platforms such as Google, Facebook, or when participating in affiliate marketing programs.

If you’re looking to learn more about how your personal tax code affects your marketing and how to optimize your marketing strategy, visit Brand Manager for more in-depth marketing articles. Useful information will help you seize opportunities and grow your business effectively in a competitive digital environment.